Houseowner / Householder

Comprehensive home policy covering your private dwelling house, flat or apartment, along with its contents.

Important notice

You must ensure that your property is insured at the appropriate amount. You should read and understand the insurance policy and discuss with your insurance adviser or contact the insurance company directly for more information.

MSIG Insurance (Malaysia) Bhd is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM's TIPS Brochure or contact MSIG Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

Key benefits

Comprehensive coverage

Comprehensive coverage including fire, lightning, domestic explosion, aircraft damage, impact damage by road vehicles or animals, bursting or overflowing of water tanks or pipes, theft and burglary, earthquake or volcanic eruption, flood, hurricane, typhoon, windstorm, loss of rent, public liability, etc.

MSIG Home Assist Programme

Referral services include emergency and maintenance works, physical works, structural works, waterworks, restoration works and miscellaneous works, among many others.

Coverage

Read the product disclosure sheet and general terms and conditions before taking out this insurance. View downloads

- Fire, lightning, thunderbolt, subterranean fire

- Explosion

- Aircraft damage

- Impact damage by road vehicles or animals

- Bursting or overflowing of water tanks, apparatus or pipes #

- Theft but only if accompanied by actual forcible and violent entry or exit

- Hurricane, cyclone, typhoon or windstorm (storm & tempest) ##

- Earthquake or volcanic eruption ##

- Flood excluding loss or damage caused by subsidence or landslip ##

- Robbery and hold up in the premises

- Loss of rent up to the limit of 10% of total sum insured on building and/or contents

- Owner’s liability up to RM50,000 on building and contents, each section respectively

- Contents temporarily removed from the house limited to 15% of the total sum insured on contents*

- Damage to mirrors, other than hand mirrors, limited to RM500.00 per piece any one incident*

- Compensation for death of the Insured, maximum compensation of RM10,000 or one half of the total sum insured on contents, whichever is less*

* - Applicable to Householder policy only.

For peril marked with #, the first RM50.00 is not covered.

For peril marked with ##, the first 1% of the total sum insured on buildings or RM200.00, whichever is less.

Note: Please refer to the brochure or contact your MSIG Insurance Adviser.

- War, civil war and act of terrorism

- Radioactive and nuclear energy risks

- Date recognition

- Property damage to data or software

- The ‘Liability to the Public’ section does not cover any asbestos related injury or damage involving the use, presence, existence, detection, removal, elimination or avoidance of asbestos or exposure or potential exposure to asbestos

Note: This list is non-exhaustive. Please refer to the sample Policy Document for the full list of exclusions under this policy.

Building Cost Calculator (BCC)

A guide to help you in determining the estimated sum to be insured for your house.

Add-on

Extension to basic cover

On building

On contents

Landlord’s household goods and furnishings in blocks of flats

Plate glass damage

Damage by hurricane, cyclone, typhoon or windstorm to metal smoke stacks, awnings, blinds, signs and other outdoor fixtures and fittings including gates and fences

Alterations, repairs and additions

Unoccupancy in excess of 90 days

Extended theft cover (without evidence of forced and violent entry or exit)

Subsidence and landslip

Riot, strike and malicious damage

Additional rent insurance

Increased limits of owner’s liability

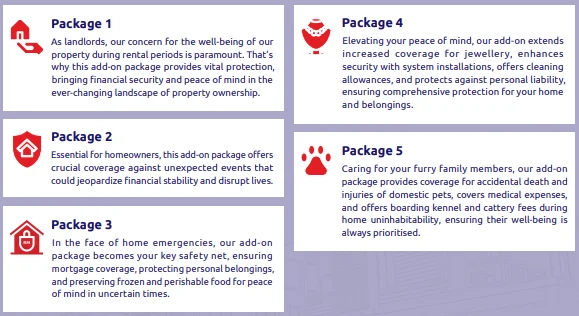

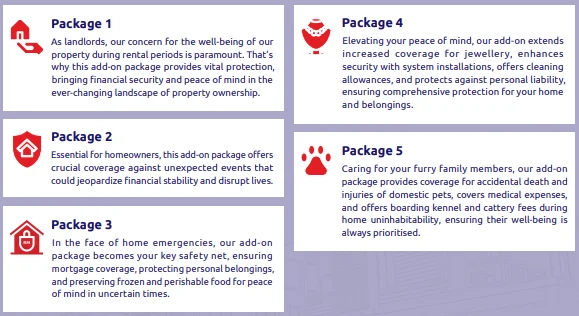

Home Protector

Safeguard every facet of your home with our all-encompassing Home Protector* add-on packages. From property and possessions to your pets, we ensure your sanctuary remains protected against life’s unforeseen twists, providing support and stability for you and your loved ones.

Download the full leaflet here.

Available with

Extension to basic cover

On building

On contents

Landlord’s household goods and furnishings in blocks of flats

Plate glass damage

Damage by hurricane, cyclone, typhoon or windstorm to metal smoke stacks, awnings, blinds, signs and other outdoor fixtures and fittings including gates and fences

Alterations, repairs and additions

Unoccupancy in excess of 90 days

Extended theft cover (without evidence of forced and violent entry or exit)

Subsidence and landslip

Riot, strike and malicious damage

Additional rent insurance

Increased limits of owner’s liability

Home Protector

Safeguard every facet of your home with our all-encompassing Home Protector* add-on packages. From property and possessions to your pets, we ensure your sanctuary remains protected against life’s unforeseen twists, providing support and stability for you and your loved ones.

Download the full leaflet here.

Available with

View allFrequently asked questions

The amount of compensation depends on the basis of the cover:

- Market Value – It will pay the value of the property insured at the time of damage or loss less due allowance for wear and tear and/or depreciation and subject to the deduction of any excess and amounts which you required to bear under the policy.

- Reinstatement Value (new for old) – It will pay full cost of repairing the damaged building without any deductions being made for wear, tear or depreciation, provided that the sum insured is adequate to cover the total cost of reinstating the building.

The price you pay will be based on the sum insured, type of building and construction materials used. The insurance premium charged for this policy is in accordance with the Revised Fire Tariff which is regulated by the General Insurance Association of Malaysia (Persatuan Insurans Am Malaysia).

You are required to declare only those articles of greater value than 5% of the total sum insured on the household contents (except furniture, pianos, organs, household appliances, radios, television sets, video recorders, hi-fi equipment and the like).

If you do not insure your property at full value, the average condition will apply and you cannot claim for the full amount of loss. For example, if the full value of the house is RM500,000, and you only insure for RM400,000. If your loss on the property is estimated at RM100,000, you can only get back RM80,000 calculated as follows:

Claim amount : (Sum insured : RM400,000 / Rebuilding cost : RM500,000) X Loss : RM100,000 = RM80,000

Downloads

Houseowner/Householder Policy Wording (EN)

Houseowner/Householder Policy Wording (BM)

Houseowner/Householder Brochure with PDS (EN, BM)

Houseowner/Householder Proposal Form (EN, BM)

Home Assist Booklet (EN, BM, CH)

Ready to get covered?

Coverage you might need

EZ Home Essentials

Customizable coverage plan to safeguard what matters most to you.

Solar PV for Home

Protects your solar PV system from loss or damage caused by fire, theft, accidents and more.

Home SafeGuard

Full protection for your building on an agreed value basis.

All-In-Home

Comprehensive coverage for accidental loss or damage to your home contents.