Senior Citizen PA

Seniors' accident coverage with low premiums, tailored benefits and 24/7 global protection.

Important notice

You are advised to note the scale of benefits for death and disablement in your insurance policy. You must nominate a nominee and ensure that your nominee is aware of the personal accident policy that you have purchased. You should read and understand the insurance policy and discuss with your insurance adviser or contact the insurance company directly for more information.

MSIG Insurance (Malaysia) Bhd is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM's TIPS Brochure or contact MSIG Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

Key benefits

Accidental Death and/or Permanent Disablement

Because you need full coverage 24 hours a day, anywhere in the world, especially if you love travelling.

Convalescence Allowance

Because you may need to make alterations to your home to make it safer and more accessible should you be certified as wheelchair-bound by your doctor for minimum of 6 months.

Hospital Income

Because you should have extra cash on hand if you are hospitalised due to an accident (maximum of 15 weeks).

Nursing Care

Because you may be certified by your doctor that you need to hire special nursing care upon discharge (maximum of 4 weeks).

Personal Liability

Because you could be sued for causing accidental injury to someone or accidental damage to property.

Coverage

Read the product disclosure sheet and general terms and conditions before taking out this insurance. View downloads

- Accidental Death and/or Permanent Disablement

- Convalescence Allowance

- Hospital Income

- Nursing Care

- Medical Expenses

- Funeral, Cremation and Repatriation Expenses

- Personal Liability

Note: Duration of cover is for 1 year. It may be renewed on each anniversary of the Date of Inception of the Policy by payment of the premium determined by the Company at the time of renewal.

- War and related risks

- Government regulations or acts or authorities

- Suicide, self-inflicted injury, unlawful act or wilful exposure to peril (other than in an attempt to save a human life)

- Pregnancy, childbirth, physical or mental defect or infirmity

- AIDS or AIDS-related complex (ARC)

- Drug abuse unless the drug is taken in accordance with an authorised medical prescription (but not for the treatment of drug addiction)

- Air travel except as a passenger in a fully licensed passenger carrying aircraft

- Any crew, trade, technical or sporting activity in connection with an aircraft

- Act of Terrorism

Note: This list is non-exhaustive. Please refer to the policy contract for the full list of exclusions under this policy.

Plans

Plan 1

Starting from RM81.00/yr

Benefits

Max RM

Accidental death and/or permanent disablement

50,000

Convalescence allowance

5,000

Hospital income (per week)

500

Nursing care (per week)

125

Medical expenses

500

Funeral, cremation, repatriation expenses

2,000

Personal liability - Third party bodily injury/property damage

50,000

Plan 2

Starting from RM162.00/yr

Benefits

Max RM

Accidental death and/or permanent disablement

100,000

Convalescence allowance

5,000

Hospital income (per week)

500

Nursing care (per week)

125

Medical expenses

1,000

Funeral, cremation, repatriation expenses

2,000

Personal liability - Third party bodily injury/property damage

100,000

Plan 3

Starting from RM243.00/yr

Benefits

Max RM

Accidental death and/or permanent disablement

150,000

Convalescence allowance

5,000

Hospital income (per week)

500

Nursing care (per week)

125

Medical expenses

1,500

Funeral, cremation, repatriation expenses

2,000

Personal liability - Third party bodily injury/property damage

150,000

Plan 4

Starting from RM291.60/yr

Benefits

Max RM

Accidental death and/or permanent disablement

200,000

Convalescence allowance

5,000

Hospital income

500

Nursing care

125

Medical expenses

2,000

Funeral, cremation, repatriation expenses

2,000

Personal liability - Third party bodily injury/property damage

200,000

Plan 5

Starting from RM372.60/yr

Benefits

Max RM

Accidental death and/or permanent disablement

250,000

Convalescence allowance

5,000

Hospital income (per week)

500

Nursing care (per week)

125

Medical expenses

2,500

Funeral, cremation, repatriation expenses

2,000

Personal liability - Third party bodily injury/property damage

250,000

Add-on

Assisted Living

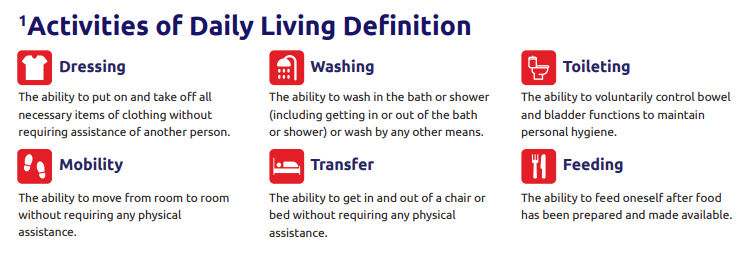

Accidents and unforeseen events can happen to anyone, turning life’s simplest tasks into insurmountable challenges. Imagine no longer being able to perform basic activities like dressing, eating, or moving without assistance.

MSIG PA Add-On: Assisted Living is designed to help ease your financial burden during these difficult times. Our benefits are structured to support assisted living and disability assessment expenses subject to the following conditions:

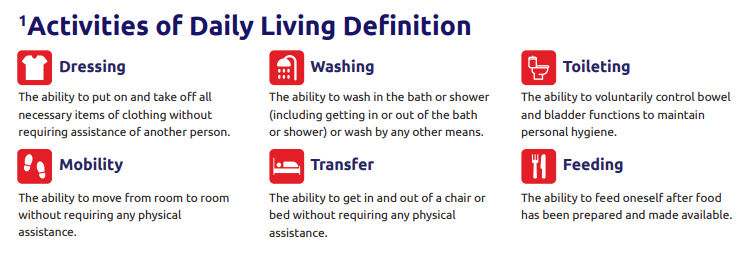

• You must be unable to independently perform at least 3 Activities of Daily Living (ADLs)1

• Your inability to perform at least 3 ADLs must be assessed and certified by a registered medical practitioner / doctor.

• Due to your inability to perform ADLs, you require nursing care or services:

▪ at a registered nursing home or care centre; or

▪ of a licensed nurse provided at your home.

• A follow-up assessment is required at 6 months after the initial certification of your inability to perform ADLs for reimbursement of claims.

Available with

Assisted Living

Accidents and unforeseen events can happen to anyone, turning life’s simplest tasks into insurmountable challenges. Imagine no longer being able to perform basic activities like dressing, eating, or moving without assistance.

MSIG PA Add-On: Assisted Living is designed to help ease your financial burden during these difficult times. Our benefits are structured to support assisted living and disability assessment expenses subject to the following conditions:

• You must be unable to independently perform at least 3 Activities of Daily Living (ADLs)1

• Your inability to perform at least 3 ADLs must be assessed and certified by a registered medical practitioner / doctor.

• Due to your inability to perform ADLs, you require nursing care or services:

▪ at a registered nursing home or care centre; or

▪ of a licensed nurse provided at your home.

• A follow-up assessment is required at 6 months after the initial certification of your inability to perform ADLs for reimbursement of claims.

Available with

Frequently asked questions

All Malaysians and Permanent Residents who are retired or engaged in non-manual occupations between 55 to 75 years of age.

You may cancel the cover at any time by notifying us in writing. Any refund of premium is based on the pro-rata basis and depend on how long the cover has been in force and subject to the Company retaining a minimum premium of RM60.00 and the prevailing Service Tax and whether any claims have been made. The Company may cancel this cover or any Section by sending 7 days’ notice by recorded delivery letter or registered letter to your last known address and the refund of premium will depend on how long the cover has been in force and whether any claims have been made.

Please provide a written notice to the Company with full details within 7 days upon receiving notice of or sustaining any accident, loss or damage. You may contact any MSIG Branch or your insurance adviser to obtain a copy of the claim form. Submit the completed claim form here to the Company together with all relevant documents as soon as possible.

Just complete the proposal form here and send it to us, or your insurance adviser.

If you have a complaint about our product or services, or you are not satisfied with the rejection or offer of any settlement of a claim, you should first try to resolve the complaint with our Customer Service Centre.

If you are still not satisfied with the decision, you can write either to the BNMLINK of Bank Negara Malaysia or the Financial Markets Ombudsman Service (FMOS) (formerly known as Ombudsman for Financial Services (OFS)), free of charge.

Downloads

Senior Citizens Personal Accident Insurance Brochure with Product Disclosure Sheet (EN, BM)

Senior Citizens Personal Accident Proposal Form

Senior Citizens Personal Accident Insurance Product Disclosure Sheet (EN)

Senior Citizens Personal Accident Insurance Product Disclosure Sheet (BM)

Assisted Living PA Add-On Leaflet (EN, BM)

Assisted Living PA Add-On Leaflet (CH)

Assisted Living PA Add-On Product Disclosure Sheet (EN)

Assisted Living PA Add-On Product Disclosure Sheet (BM)

Assisted Living PA Add-On Proposal Form

Nomination

Nomination is important to ensure that your loved ones will receive the protection as intended by you and that policy moneys may be paid out by insurers without any delay. Where no nomination is made, the policy moneys will be paid out to your lawful executor (if you have made a Will) or your lawful administrator (if no Will has been made) – this process will take a while.

*If there is no lawful executor or administrator, then the policy moneys will be paid out to the rightful persons in accordance with applicable distribution laws.

You can nominate any individual(s) you want. HOWEVER, not all nominees will receive the policy moneys beneficially or for their own use. Depending on your marital status and who you nominate, nominations may produce unexpected results for the nominee(s). Likewise, nominations by a Muslim policy owner and non-Muslim policy owner will have different consequences.

How so?

Nominations made by a non-Muslim policy owner will create either (i) a trust policy in favour of the nominee(s) or (ii) a non-trust policy.

To ensure that your nominee(s) receive the policy moneys as intended, you need to ensure that a trust policy is created in favour of your nominee(s).

Trust policy will be created:

(a) if the nominee is your spouse or child; or

(b) if the nominee is your parent (provided that there is no living spouse or child at the time you make the nomination).

In such as case, you are creating a non-trust policy. Here, your nominee will only receive the policy moneys as executor and distribute the policy moneys in accordance with your Will or where there is no Will, in accordance with applicable distribution laws. If you intend for these nominee(s) to receive the policy moneys beneficially and not as executor, you will need to assign the policy benefits to them.

In brief, if you nominate people other than your spouse, children or parents, make sure to assign the policy benefits to them to ensure that they receive the policy moneys for their own use. Please contact MSIG if you require more information on this.

Nominee(s) irrespective of the relationship with the policy owner can only receive the policy moneys as executor and the policy moneys must be distributed in accordance with Islamic laws.

Ready to get covered?

Coverage you might need

Gig PA

24/7 global accident plan compensating for accidental disability or death, including daily hospital allowance.

Tenang Hospital Income

Daily cash allowance for hospitalization due to accident or COVID-19.

Prime PA

Comprehensive accident coverage, including terrorism and hijacking, extending up to age 80.

PA Add-On

Offers the flexibility to expand your coverage for added peace of mind.