PA Add-On

Offers the flexibility to expand your coverage for added peace of mind.

MSIG Insurance (Malaysia) Bhd is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM's TIPS Brochure or contact MSIG Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

How it works

01

Choose your preferred plan

02

Pair with compatible add-on

03

Relax, you're all covered

Add-on

Traditional Chinese Medicine Expenses

Traditional Chinese Medicine (TCM) is an alternative form of treatment that incorporates a more holistic and natural approach to take care of one’s health and well-being. That is why we go above and beyond to ease the process of seeking TCM treatment and be reimbursed for its expenses should you opt for it as a treatment.

You can now extend your MSIG Personal Accident (PA) policy, if eligible, with an Add-on that provides an annual reimbursement limit for TCM Expenses, without having to first seek treatment at a clinic registered with the Ministry of Health Malaysia, provided that you have consulted and received your first treatment from a Chinese Physician who is duly licensed or registered with a Traditional Chinese Medicine Practitioners Board in Malaysia within five (5) days of sustaining an injury.

With this Add-on, you will be entitled to a separate reimbursement limit for TCM Expenses. The TCM reimbursement entitlement under the Medical Expenses Benefit of your MSIG PA policy will not be applicable. The Medical Expenses Benefit will be solely for the reimbursement of medical expenses incurred for treatment of an injury at a hospital or clinic.

Available with

Assisted Living

Accidents and unforeseen events can happen to anyone, turning life’s simplest tasks into insurmountable challenges. Imagine no longer being able to perform basic activities like dressing, eating, or moving without assistance.

MSIG PA Add-On: Assisted Living is designed to help ease your financial burden during these difficult times. Our benefits are structured to support assisted living and disability assessment expenses subject to the following conditions:

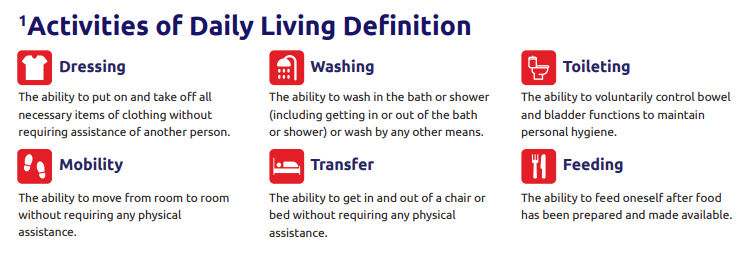

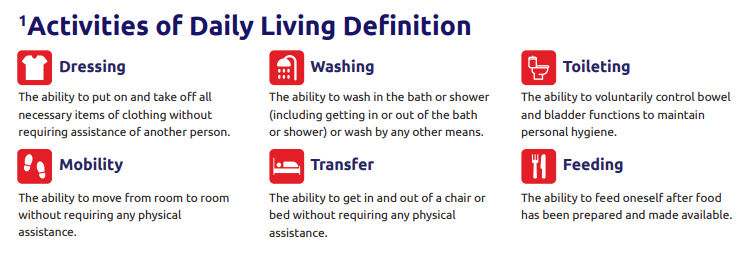

• You must be unable to independently perform at least 3 Activities of Daily Living (ADLs)1

• Your inability to perform at least 3 ADLs must be assessed and certified by a registered medical practitioner / doctor.

• Due to your inability to perform ADLs, you require nursing care or services:

▪ at a registered nursing home or care centre; or

▪ of a licensed nurse provided at your home.

• A follow-up assessment is required at 6 months after the initial certification of your inability to perform ADLs for reimbursement of claims.

Available with

Traditional Chinese Medicine Expenses

Traditional Chinese Medicine (TCM) is an alternative form of treatment that incorporates a more holistic and natural approach to take care of one’s health and well-being. That is why we go above and beyond to ease the process of seeking TCM treatment and be reimbursed for its expenses should you opt for it as a treatment.

You can now extend your MSIG Personal Accident (PA) policy, if eligible, with an Add-on that provides an annual reimbursement limit for TCM Expenses, without having to first seek treatment at a clinic registered with the Ministry of Health Malaysia, provided that you have consulted and received your first treatment from a Chinese Physician who is duly licensed or registered with a Traditional Chinese Medicine Practitioners Board in Malaysia within five (5) days of sustaining an injury.

With this Add-on, you will be entitled to a separate reimbursement limit for TCM Expenses. The TCM reimbursement entitlement under the Medical Expenses Benefit of your MSIG PA policy will not be applicable. The Medical Expenses Benefit will be solely for the reimbursement of medical expenses incurred for treatment of an injury at a hospital or clinic.

Available with

Assisted Living

Accidents and unforeseen events can happen to anyone, turning life’s simplest tasks into insurmountable challenges. Imagine no longer being able to perform basic activities like dressing, eating, or moving without assistance.

MSIG PA Add-On: Assisted Living is designed to help ease your financial burden during these difficult times. Our benefits are structured to support assisted living and disability assessment expenses subject to the following conditions:

• You must be unable to independently perform at least 3 Activities of Daily Living (ADLs)1

• Your inability to perform at least 3 ADLs must be assessed and certified by a registered medical practitioner / doctor.

• Due to your inability to perform ADLs, you require nursing care or services:

▪ at a registered nursing home or care centre; or

▪ of a licensed nurse provided at your home.

• A follow-up assessment is required at 6 months after the initial certification of your inability to perform ADLs for reimbursement of claims.

Available with

Do I need

add-on?

01

Evaluate risk exposure

When considering a personal accident add-on insurance policy, evaluating risk exposure involves assessing the likelihood and potential impact of accidents on your financial stability.

02

Assess coverage scope

Understand the intended scope of the policy, whether it’s for personal protection, family coverage, or travel.

03

Value of financial protection

Establish the financial support required for medical expenses, disability, or accidental death.

01

Evaluate risk exposure

When considering a personal accident add-on insurance policy, evaluating risk exposure involves assessing the likelihood and potential impact of accidents on your financial stability.

02

Assess coverage scope

Understand the intended scope of the policy, whether it’s for personal protection, family coverage, or travel.

03

Value of financial protection

Establish the financial support required for medical expenses, disability, or accidental death.

Nomination

Nomination is important to ensure that your loved ones will receive the protection as intended by you and that policy moneys may be paid out by insurers without any delay. Where no nomination is made, the policy moneys will be paid out to your lawful executor (if you have made a Will) or your lawful administrator (if no Will has been made) – this process will take a while.

*If there is no lawful executor or administrator, then the policy moneys will be paid out to the rightful persons in accordance with applicable distribution laws.

You can nominate any individual(s) you want. HOWEVER, not all nominees will receive the policy moneys beneficially or for their own use. Depending on your marital status and who you nominate, nominations may produce unexpected results for the nominee(s). Likewise, nominations by a Muslim policy owner and non-Muslim policy owner will have different consequences.

How so?

Nominations made by a non-Muslim policy owner will create either (i) a trust policy in favour of the nominee(s) or (ii) a non-trust policy.

To ensure that your nominee(s) receive the policy moneys as intended, you need to ensure that a trust policy is created in favour of your nominee(s).

Trust policy will be created:

(a) if the nominee is your spouse or child; or

(b) if the nominee is your parent (provided that there is no living spouse or child at the time you make the nomination).

In such as case, you are creating a non-trust policy. Here, your nominee will only receive the policy moneys as executor and distribute the policy moneys in accordance with your Will or where there is no Will, in accordance with applicable distribution laws. If you intend for these nominee(s) to receive the policy moneys beneficially and not as executor, you will need to assign the policy benefits to them.

In brief, if you nominate people other than your spouse, children or parents, make sure to assign the policy benefits to them to ensure that they receive the policy moneys for their own use. Please contact MSIG if you require more information on this.

Nominee(s) irrespective of the relationship with the policy owner can only receive the policy moneys as executor and the policy moneys must be distributed in accordance with Islamic laws.

Downloads

Traditional Chinese Medicine Expenses PA Add-On Leaflet (EN, BM)

Traditional Chinese Medicine Expenses PA Add-On Leaflet (CH)

Traditional Chinese Medicine Expenses PA Add-On PDS (EN, BM)

Assisted Living PA Add-On Leaflet (EN, BM)

Assisted Living PA Add-On Leaflet (CH)

Assisted Living PA Add-On Product Disclosure Sheet (EN)

Assisted Living PA Add-On Proposal Form

Ready to get covered?

Coverage you might need

Gig PA

24/7 global accident plan compensating for accidental disability or death, including daily hospital allowance.

Tenang Hospital Income

Daily cash allowance for hospitalization due to accident or COVID-19.

Senior Citizen PA

Seniors' accident coverage with low premiums, tailored benefits and 24/7 global protection.

Prime PA

Comprehensive accident coverage, including terrorism and hijacking, extending up to age 80.