Home Add-On

Add-on plans for comprehensive and customized coverage tailored to your needs.

MSIG Insurance (Malaysia) Bhd is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM's TIPS Brochure or contact MSIG Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

How it works

01

Choose your preferred plan

02

Pair with compatible add-on

03

Relax, you're all covered

Add-on

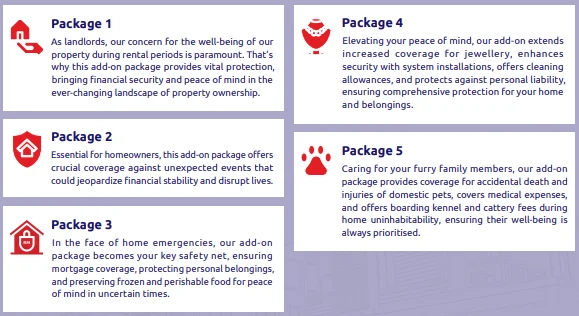

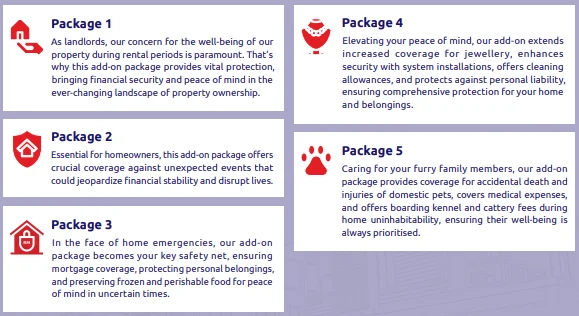

Home Protector

Safeguard every facet of your home with our all-encompassing Home Protector* add-on packages. From property and possessions to your pets, we ensure your sanctuary remains protected against life’s unforeseen twists, providing support and stability for you and your loved ones.

Download the full leaflet here.

Available with

Hospitalisation Inconvenience Benefit

To provide a daily cash benefit for up to a maximum of 30 consecutive days of hospitalisation for injuries resulting from an accident that occurred in your home, from insured perils or events under your Houseowner/Householder Insurance, or dengue fever.

This Hospitalisation Inconvenience Benefit add-on covers up to a maximum of six named family members (domestic helpers included) who are between the ages of 15 days and 75 years residing in your home.

Terms and Conditions apply to both. Please see the product leaflet for more information.

Available with

Landslip or Landslide

To cover loss or damage to your insured property caused by landslip or landslide up to the specified Limit, at an Excess amount of your choice.

Terms and Conditions apply to both. Please see the product leaflet for more information.

Available with

Home Protector

Safeguard every facet of your home with our all-encompassing Home Protector* add-on packages. From property and possessions to your pets, we ensure your sanctuary remains protected against life’s unforeseen twists, providing support and stability for you and your loved ones.

Download the full leaflet here.

Available with

Hospitalisation Inconvenience Benefit

To provide a daily cash benefit for up to a maximum of 30 consecutive days of hospitalisation for injuries resulting from an accident that occurred in your home, from insured perils or events under your Houseowner/Householder Insurance, or dengue fever.

This Hospitalisation Inconvenience Benefit add-on covers up to a maximum of six named family members (domestic helpers included) who are between the ages of 15 days and 75 years residing in your home.

Terms and Conditions apply to both. Please see the product leaflet for more information.

Available with

Landslip or Landslide

To cover loss or damage to your insured property caused by landslip or landslide up to the specified Limit, at an Excess amount of your choice.

Terms and Conditions apply to both. Please see the product leaflet for more information.

Available with

Do I need

add-on?

01

Evaluate risk exposure

Evaluating risk exposure for home add-on insurance products involves assessing the various risks that a property may face and determining the appropriate coverage needed to mitigate those risks.

02

Assess property usage

Consider how your property is utilized, whether as a primary residence, a rental, or a secondary home.

03

Value of your home and contents

Determine the total value of your home and its contents, including renovations and personal belongings.

01

Evaluate risk exposure

Evaluating risk exposure for home add-on insurance products involves assessing the various risks that a property may face and determining the appropriate coverage needed to mitigate those risks.

02

Assess property usage

Consider how your property is utilized, whether as a primary residence, a rental, or a secondary home.

03

Value of your home and contents

Determine the total value of your home and its contents, including renovations and personal belongings.

Downloads

Hospitalisation Inconvenience Benefit Leaflet with Proposal Form (EN,BM)

Landslip or Landslide Leaflet (EN,BM)

Home Protector Houseowner/Householder Add-On Leaflet (EN, BM)

Home Protector Houseowner/Householder Add-On PDS (EN)

Home Protector Houseowner/Householder Add-On PDS (BM)

Ready to get covered?

Coverage you might need

EZ Home Essentials

Customizable coverage plan to safeguard what matters most to you.

Solar PV for Home

Protects your solar PV system from loss or damage caused by fire, theft, accidents and more.

Houseowner / Householder

Comprehensive home policy covering your private dwelling house, flat or apartment, along with its contents.

Home SafeGuard

Full protection for your building on an agreed value basis.