Motor Claims

Eligible products

What to do

01

Lodge a police report within 24 hours

03

For accident damaged vehicles...

Send your vehicle to an MSIG authorised panel repairer. They will also assist you in claim submission (For Comprehensive Motor Policyholder Only).

05

For accidents involving a third party...

Provide third-party details to MSIG, avoid negotiations without consent, notify MSIG of any police action, refer third-party claims to MSIG and forward all documents promptly.

MSIG Motor Assist

Your policy comes with FREE Assistance!

What you need

Make sure you have everything when you submit the claim form.

View downloads

-

Original / certified copy of Police Report

-

Copy of Policy / Cover Note

-

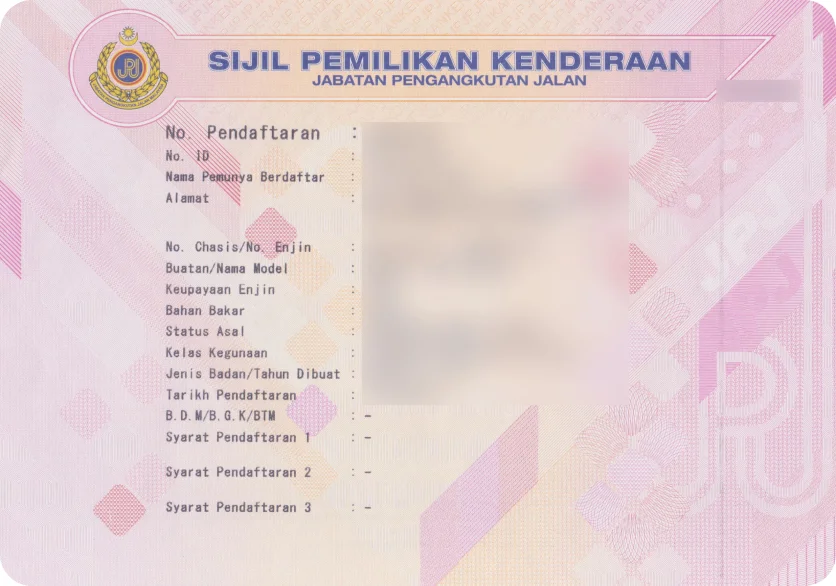

Copy of Vehicle Registration Card / copy of Vehicle Ownership Certificate

Show info Ensure all details are visible, including the vehicle number, owner name, and expiry date.

![Sample VOC]()

Show info Ensure all details are visible, including the vehicle number, owner name, and expiry date.

![Sample VOC]()

-

Copy of your Identity Card and driving license

-

Copy of your driver's Identity Card and driving license

(if you were not the driver at the time of accident)

Frequently asked questions

You can submit your claim notification:

- Click here for all MSIG Online products; or

- by providing us with written notice together with the completed claim form and all relevant documents either by mail, email or walk in to our office as soon as possible.

Please click on the respective claims tabs above for instructions on submitting a claim via - written notice.

If you have any clarification or need assistance, please contact MSIG Customer Service Hotline or any MSIG Branch.

Once a claim has been made, you’ll receive an email acknowledgement. The email lists all the necessary documents needed to support the claim and other details.

Depends on the type of claim, the turnaround time for example, death/theft claim will be longer than a smaller type of claim. Be assured MSIG is committed to fair and prompt settlement of claims.

If no nominee was elected, we'll pay the policy moneys to your lawful executor (the person you named as such in your Will) or administrator (if you don't have a Will, this is the person who has been granted administration of your estate by the Court).

If there is no lawful executor or administrator, we will follow Section 6 of the Distribution Act 1958 and pay the policy moneys to your spouse, child or parent.

It can get pretty complicated, which is why we always recommend you to elect a nominee.

If your policy moneys is not more than RM100,000, we may pay it (without a need for grant of probate, letters of administration or distribution order) to a person that we deem entitled to the policy moneys under your Will (if any) or under any law relating to the disposition of property. A person can also be deemed entitled if he/she is named as an executor in your Will, or has the consent of all your lawful beneficiaries to be administrator to your estate.

If the policy moneys is more than RM100, 000, we may then firstly pay RM100, 000 to the person referred above and the balance of the policy moneys to your lawful executor or administrator.

Confused? Take the stress away and elect a nominee instead.