Motor Plus

Add more, save more with the widest coverage! This policy includes 7 pre-bundled add-ons, with options to add even more.

Important notice

You must ensure that your vehicle is insured at the appropriate amount as it will affect the amount you can claim. You must nominate a nominee and ensure that your nominee is aware of the personal accident policy that you have purchased. You should read and understand the insurance policy and discuss with your insurance adviser or contact the insurance company directly for more information.

MSIG Insurance (Malaysia) Bhd is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM's TIPS Brochure or contact MSIG Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

Key benefits

Packaged Add-on

Our flagship motor insurance product, Motor Plus includes popular additional benefits like Driver's Personal Accident, Full Special Perils, Legal Liability to Passengers, Legal Liability of Passengers, Waiver of Compulsory Excess, Strike, Riot and Civil Commotion, and 24-Hour Unlimited Towing Service. All of this for a special packaged premium.

Comprehensive cover

MSIG Motor Plus Insurance is a comprehensive motor policy with extended coverage packaged in a single policy that provides ease and convenience to customers in purchasing motor insurance.

For more information, please click Coverage below.

Waiver of betterment cost

Optional add-on that waives the betterment charges arising from original spare parts cost.

Get an exclusive rate for Waiver of Betterment Cost add-on when you purchase MSIG Motor Plus Policy.

Coverage

Read the product disclosure sheet and general terms and conditions before taking out this insurance.

View downloads

- Third party bodily injury or death

- Third party property loss or damage

- Loss or damage to your own vehicle due to accidental fire, theft or accident

- Driver's personal accident

- Full special perils

- Legal liability to passengers

- Legal liability of passengers

- Waiver of compulsory excess

- Strike, riot and civil commotion

- 24-hour unlimited towing service

Driver’s Personal Accident

Provides cover for the driver and passenger travelling in the insured car against death or permanent disablement due to road accident.

Full Special Perils

Provides cover for loss or damage due to flood, typhoon, hurricane, storm, tempest, volcanic eruption, earthquake, landslide, landslip, subsidence, or sinking of the soil/earth or other convulsions of nature.

Legal Liability to Passengers

Provides cover against legal liability sought by your passengers against you in the event of an accident due to your negligence.

Legal Liability of Passengers

Provides cover against legal liability sought by third party against you for the actions of your passengers.

Waiver of Compulsory Excess

Waiver of the compulsory excess of RM400 if policyholder/you or the person driving your car:

- is under 21 years old;

- holds a Provisional (P) or Learners (L) driver’s license; or

- is not named in the Schedule as a named driver.

Strike, Riot and Civil Commotion

Covers the car against loss or damage due to strike, riot and civil commotion.

24-Hour Unlimited Towing Service

MSIG Motor Assist will tow the car for an unlimited distance to the workshop/home at no additional cost.

The territorial limits are as follows:

- No limit for anywhere in Malaysia including the islands of Penang, Langkawi, Labuan, Pangkor and Redang;

- No limit for Singapore;

- 130km (round trip) for Thailand;

- 130km (round trip) for Brunei.

Note: Duration of cover is for one year. You need to renew the insurance cover annually.

- Consequential loss, depreciation, wear and tear, mechanical or electrical breakdown failures or breakages

- War and related risks

Note: This list is non-exhaustive. Please refer to the Policy Document for the full list of exclusions under this Policy.

Add-on

Waiver of betterment cost

Get an exclusive rate for Waiver of Betterment Cost add-on when you purchase MSIG Motor Plus Policy.

Waives the betterment charges arising from original spare parts cost.

Available with

EZ-Mile

Provides you a choice of plans with different mileage that lets you pay-as-you-drive and save on premium to suit your car usage during the year.

View the EZ-Mile Product Disclosure Sheet here.

View the EZ-Mile FAQ here.

Learn more

Available with

Windscreen

- Covers the breakage of glass in windscreens, front, rear, side windows, sunroof and lamination or tinting film.

- The damaged windscreen will be replaced and your No-Claim-Discount (NCD) entitlement will not be affected.

Available with

Current year "NCD" relief

Compensates the No-Claim-Discount (NCD) that you may forfeit due to a claim being made under your policy.

Available with

Smart key shield

- Covers the cost of repair, replace, and/or reprogram your Smart Car Key in the event of theft, loss, or accidental damage.

- Covers 1 set of Smart Car Key per car.

Available with

Waiver of betterment cost

Get an exclusive rate for Waiver of Betterment Cost add-on when you purchase MSIG Motor Plus Policy.

Waives the betterment charges arising from original spare parts cost.

Available with

View allEZ-Mile

Provides you a choice of plans with different mileage that lets you pay-as-you-drive and save on premium to suit your car usage during the year.

View the EZ-Mile Product Disclosure Sheet here.

View the EZ-Mile FAQ here.

Learn more

Available with

View allWindscreen

- Covers the breakage of glass in windscreens, front, rear, side windows, sunroof and lamination or tinting film.

- The damaged windscreen will be replaced and your No-Claim-Discount (NCD) entitlement will not be affected.

Available with

View allCurrent year "NCD" relief

Compensates the No-Claim-Discount (NCD) that you may forfeit due to a claim being made under your policy.

Available with

View allSmart key shield

- Covers the cost of repair, replace, and/or reprogram your Smart Car Key in the event of theft, loss, or accidental damage.

- Covers 1 set of Smart Car Key per car.

Available with

View allFrequently asked questions

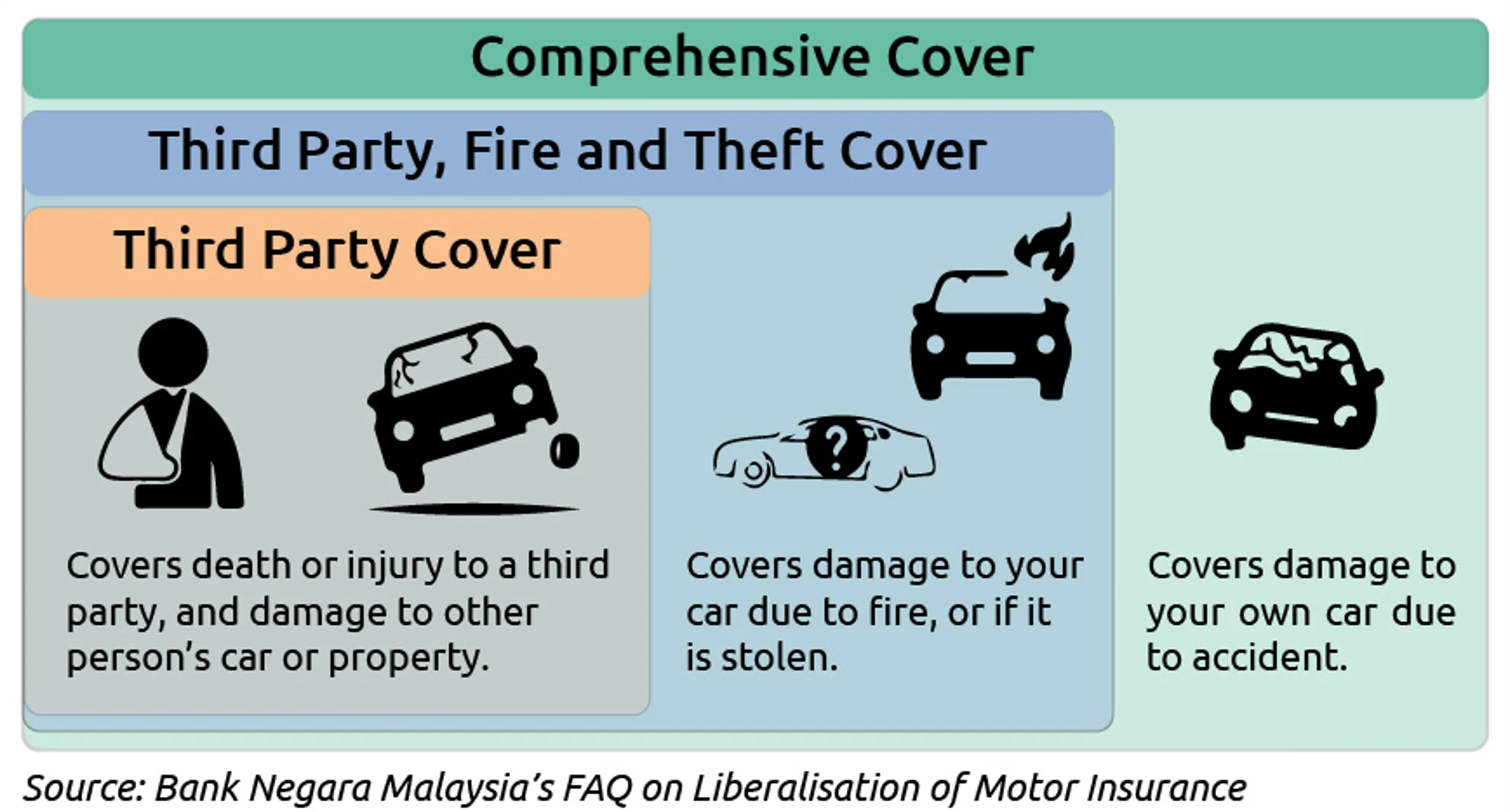

There are three main types of Motor Insurance coverage in Malaysia.

Third Party cover is a basic motor insurance cover that covers death or injury to a third party, and damage to another person’s car or property.

Third Party, Fire and Theft adds coverage for damage to the policyholder’s car due to fire, or theft of the policyholder’s car.

Comprehensive cover includes all the above as well as coverage of the policyholder’s vehicle due to accident.

For more information, do contact your MSIG Insurance adviser, or click here to get in contact.

Please provide a written notice to the Company with full details within 7 days upon receiving notice of or sustaining any accident, loss or damage. You may contact any MSIG Branch or your Insurance Adviser to obtain a copy of the claim form. Submit the completed claim form here to the Company together with all relevant documents as soon as possible.

Just complete the attached proposal form here and send it to us, or your Insurance Adviser.

You may cancel the cover at any time by notifying us in writing. Within 7 days of the cancellation, you must surrender to us the certificate of insurance or alternatively provide us with a statutory declaration. We may also cancel this cover by giving you 14 days' notice by registered post to your last known address. Details of the refund of premium are stated in the Policy, Cancellation Condition No. 3.

If you have a complaint about our product or services, or you are not satisfied with the rejection or offer of any settlement of a claim, you should first try to resolve the complaint with our Customer Service Centre.

If you are still not satisfied with the decision, you can write either to the BNMLINK of Bank Negara Malaysia or the Financial Markets Ombudsman Service (FMOS) (formerly known as Ombudsman for Financial Services (OFS)), free of charge.

Downloads

MSIG Motor Plus Insurance Policy Wording (EN)

MSIG Motor Plus Insurance Policy Wording (BM)

MSIG Motor Plus Insurance Brochure with Product Disclosure Sheet (EN, BM)

Motor Insurance Proposal Form (EN, BM)

Motor Add-On Proposal Form (EN, BM)

Motor Add-On Leaflet (EN, BM)

Ready to get covered?

Coverage you might need

Lady Motor Plus

Tailored with special coverage for female customers, all in one policy.

Comprehensive Private Car

It's more than just a vehicle. It's your trusted ride.

Comprehensive Motorcycle

Physical damage to your own motorcycle due to accidental collision or overturning or Third Party, Fire and Theft Cover plus loss.

Motorcycle 3PA

Third party coverage with added personal accident protection for the policyholder, while using the insured motorcycle.