Comprehensive Private Car

It's more than just a vehicle. It's your trusted ride.

Important notice

You must ensure that your vehicle is insured at the appropriate amount as it will affect the amount you can claim. You must nominate a nominee and ensure that your nominee is aware of the personal accident policy that you have purchased. You should read and understand the insurance policy and discuss with your insurance adviser or contact the insurance company directly for more information.

MSIG Insurance (Malaysia) Bhd is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM's TIPS Brochure or contact MSIG Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

Key benefits

Third party bodily injury or death

Covers your legal liability for causing accidental injury or loss of life to third parties in the event of a motor accident, providing essential protection for unforeseen incidents involving others.

Third party property loss or damage

Protects you from legal liability for damage to third-party property caused by your insured vehicle, ensuring financial assistance for repair or replacement costs.

Loss or damage to your own vehicle due to accidental fire, theft or accident

Offers coverage for your insured vehicle in case of damage or total loss resulting from accidental fire, theft, or road accidents, providing comprehensive protection for your vehicle.

Coverage

Read the product disclosure sheet and general terms and conditions before taking out this insurance. View downloads

- Third party bodily injury or death

- Third party property loss or damage

- Loss or damage to your own vehicle due to accidental fire, theft or accident

Note: Duration of cover is for one year. You need to renew the insurance cover annually.

- Your own death or bodily injury due to motor accident

- Your liability against claims from passengers in your vehicle

- Loss/damage arising from an act of nature, e.g. flood, landslide and landslip

- Consequential loss, depreciation, wear and tear, mechanical or electrical breakdown failures or breakages

- War and related risks

Note: This list is non-exhaustive. Please refer to the sample policy contract for the full list of exclusions under this policy.

Add-on

Driver’s personal accident

Provides cover for the driver and passenger travelling in the insured car against death or permanent disablement due to road accident, except for MSIG Lady Motor Plus, where the Personal Accident cover is only for the policyholder.

Available with

Full special perils

Provides cover for loss or damage due to flood, typhoon, hurricane, storm, tempest, volcanic eruption, earthquake, landslide, landslip, subsidence, or sinking of the soil/earth or other convulsions of nature.

Available with

24-hour unlimited towing service

Extends the existing prescribed towing limit under MSIG Motor Assist to an unlimited distance in the event of vehicle breakdown or accident.

The territorial limits are as follows:

- No limit for anywhere in Malaysia including the islands of Penang, Langkawi, Labuan, Pangkor and Redang;

- No limit for Singapore;

- 130km (round trip) for Thailand;

- 130km (round trip) for Brunei.

Available with

Windscreen

- Covers the breakage of glass in windscreens, front, rear, side windows, sunroof and lamination or tinting film.

- The damaged windscreen will be replaced and your No-Claim-Discount (NCD) entitlement will not be affected.

Available with

Smart key shield

- Covers the cost of repair, replace, and/or reprogram your Smart Car Key in the event of theft, loss, or accidental damage.

- Covers 1 set of Smart Car Key per car.

Available with

Driver’s personal accident

Provides cover for the driver and passenger travelling in the insured car against death or permanent disablement due to road accident, except for MSIG Lady Motor Plus, where the Personal Accident cover is only for the policyholder.

Available with

View allFull special perils

Provides cover for loss or damage due to flood, typhoon, hurricane, storm, tempest, volcanic eruption, earthquake, landslide, landslip, subsidence, or sinking of the soil/earth or other convulsions of nature.

Available with

View all24-hour unlimited towing service

Extends the existing prescribed towing limit under MSIG Motor Assist to an unlimited distance in the event of vehicle breakdown or accident.

The territorial limits are as follows:

- No limit for anywhere in Malaysia including the islands of Penang, Langkawi, Labuan, Pangkor and Redang;

- No limit for Singapore;

- 130km (round trip) for Thailand;

- 130km (round trip) for Brunei.

Available with

View allWindscreen

- Covers the breakage of glass in windscreens, front, rear, side windows, sunroof and lamination or tinting film.

- The damaged windscreen will be replaced and your No-Claim-Discount (NCD) entitlement will not be affected.

Available with

View allSmart key shield

- Covers the cost of repair, replace, and/or reprogram your Smart Car Key in the event of theft, loss, or accidental damage.

- Covers 1 set of Smart Car Key per car.

Available with

View allFrequently asked questions

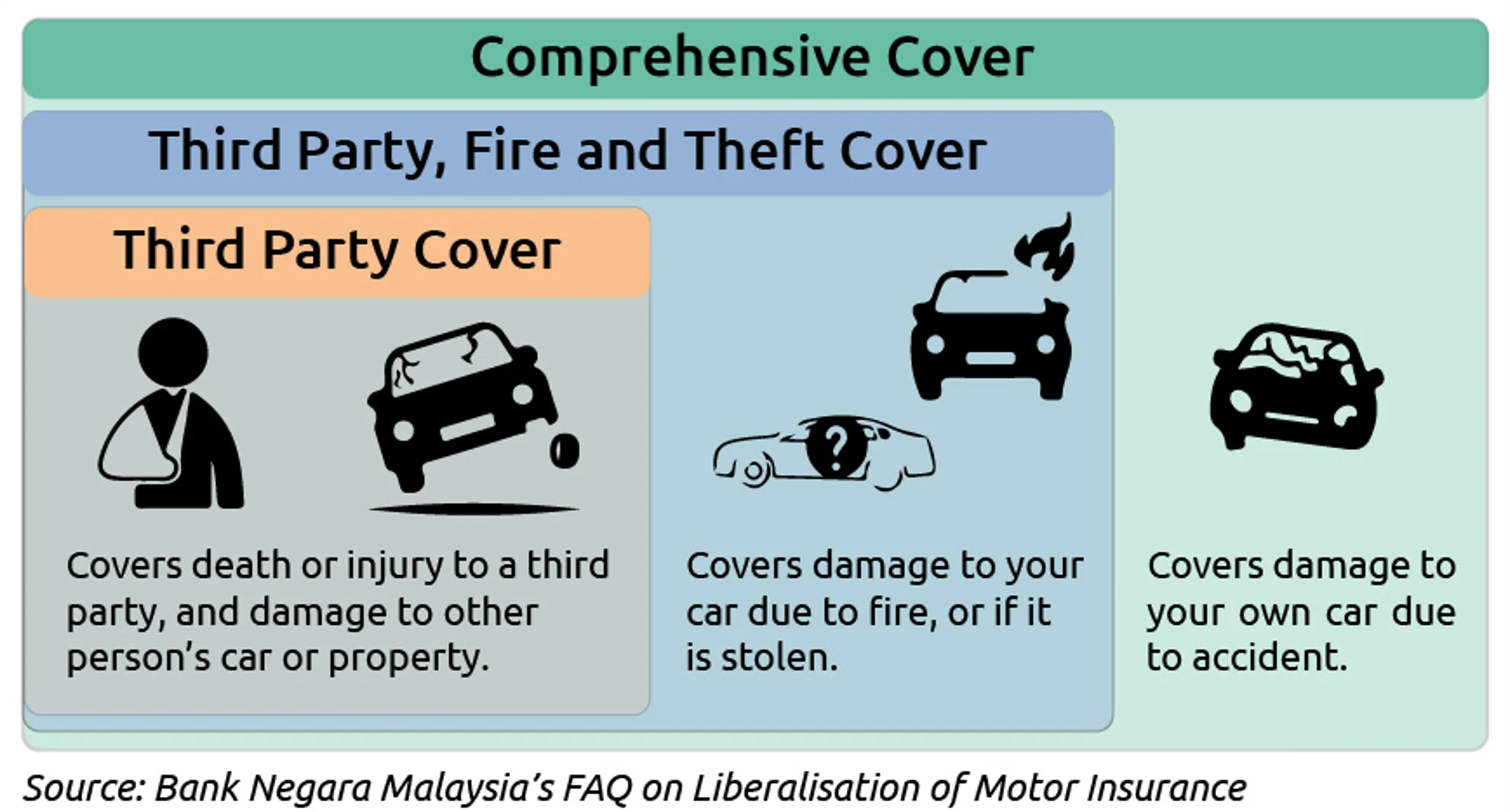

There are three main types of Motor Insurance coverage in Malaysia.

Third Party cover is a basic motor insurance cover that covers death or injury to a third party, and damage to another person’s car or property.

Third Party, Fire and Theft adds coverage for damage to the policyholder’s car due to fire, or theft of the policyholder’s car.

Comprehensive cover includes all the above as well as coverage of the policyholder’s vehicle due to accident.

For more information, do contact your MSIG Insurance adviser, or click here to get in contact.

Motor insurance markets were previously regulated with fixed pricing structures called Tariffs. In 2017, the industry began the Phased Liberalisation of Motor Insurance, gradually introducing more competitive pricing and flexibility.

Now, we are transitioning to a more dynamic pricing system based on risk factors such as driver profile, vehicle type, and historical claims data. This approach encourages competition, innovation, and more accurate pricing. The goal is to find a policy that offers the most suitable product at the most suitable price.

As a consumer purchasing motor insurance, it's important to know the available options. For more information, get in touch with your MSIG Insurance Adviser today!

Even with comprehensive motor insurance, your motor insurance policy will only cover your vehicle during an accident. That means that you will need to bear any hospitalization or ambulance fees as a result.

Do consider getting a Driver’s Personal Accident (DPA) Motor Add-on to protect yourself and your passengers*. In the event that you are injured during the accident, DPA will cover permanent total or partial disablement, medical expenses, hospital income, and more.

For more information, do contact your MSIG Insurance adviser.

*Terms and Conditions Apply.

The No Claim Discount (NCD) is a discount on your motor insurance premium when you do not make a claim during the previous year of coverage. By maintaining a claim-free record, your NCD rate increases, resulting in reduced car insurance premiums.

Protect your NCD by avoiding small claims.

NCD can be transferred to another type of vehicle of the same class if the policyholder is the same.

Your NCD stays the same even if you switch insurers.

Maintaining your NCD is a financially wise strategy that rewards safe driving and provides significant savings on car insurance premiums over time.

To find out more about NCD, kindly contact your MSIG Insurance Adviser.

Compulsory excess is a fixed sum of RM400 that you have to bear when you make an insurance claim if the driver who was driving the insured vehicle during the accident is below 21 years old; holds a Probationary license (P); or is not named under the policy.

MSIG offers the Waiver of Compulsory Excess Motor Add-On for our comprehensive motor insurance policies.

To find out more about Compulsory Excess and other important things to know about making a claim, please contact your MSIG Insurance Adviser, or click here to watch a video about the MSIG Waiver of Compulsory Excess Motor Add-on.

Downloads

Brochure and PDS (EN & BM) Motor Insurance

Product Disclosure Sheet - MSIG Comprehensive Private Car

Policy Wording (EN) - MSIG Comprehensive Private Car

Policy Wording (BM) - MSIG Comprehensive Private Car

Motor Insurance Proposal Form (EN, BM)

Motor Add-On Proposal Form (EN, BM)

Motor - Request For Change Form

Ready to get covered?

Coverage you might need

Motor Plus

Add more, save more with the widest coverage! This policy includes 7 pre-bundled add-ons, with options to add even more.

Lady Motor Plus

Tailored with special coverage for female customers, all in one policy.

Comprehensive Motorcycle

Physical damage to your own motorcycle due to accidental collision or overturning or Third Party, Fire and Theft Cover plus loss.

Motorcycle 3PA

Third party coverage with added personal accident protection for the policyholder, while using the insured motorcycle.