The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact MSIG Insurance (Malaysia) Bhd or PIDM (visit www.pidm.gov.my).

No matter how good your own driving skills are, owning a car can be an expensive and risky business. That’s why it pays to cover your vehicle against accident or theft.

The MSIG Motor Insurance offers you a thorough and comprehensive approach to motoring wherever you go. If your vehicle is already covered by another insurance company, switching over to MSIG is easy. You may transfer your NCD over in full.

To understand more about what you’ll be covered for with a selection from our Comprehensive Cover, Third Party, Fire & Theft Cover or Third Party Cover, Download MSIG Be Protected Leaflet below:

MSIG Be Protected Leaflet in ENG

MSIG Be Protected Leaflet in BM

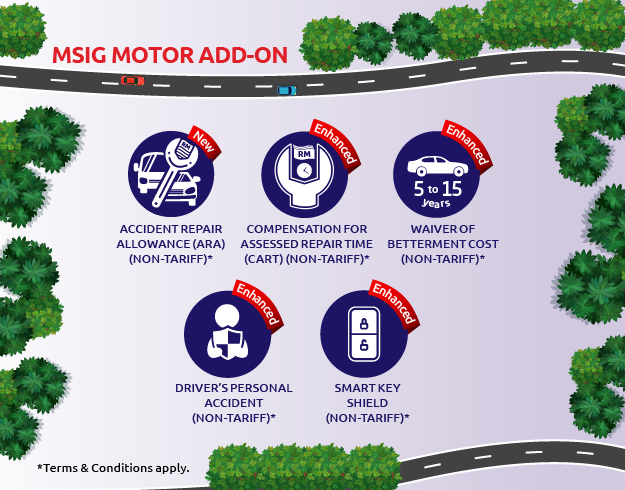

What's more, we have NEW MSIG Motor Add-On* to offer you additional benefits such as Smart Key Shield**, Special Perils - Flood, Storm, Landslide, Landslip or Subsidence Cover**, Driver's Personal Accident Insurance**, Waiver of Betterment Cost, Compensation for Assessed Repair Time (CART)**, Waiver Of Compulsory Excess* and 24-Hour Unlimited Towing Service*. Click here to find out more!

*For Comprehensive Private Car only

**Terms and Conditions apply