Third Party cover is a basic motor insurance cover that covers death or injury to a third party, and damage to another person’s car or property.

Third Party, Fire and Theft adds coverage for damage to the policyholder’s car due to fire, or theft of the policyholder’s car.

Comprehensive cover includes all the above as well as coverage of the policyholder’s vehicle due to accident.

For more information, do contact your MSIG Insurance adviser, or click here to get in contact.

Did you know? Even with comprehensive motor insurance, your motor insurance policy will only cover your vehicle during an accident. That means that you will need to bear any hospitalization or ambulance fees as a result.

Do consider getting a Driver’s Personal Accident (DPA) Motor Add-on to protect yourself and your passengers*. In the event that you are injured during the accident, DPA will cover permanent total or partial disablement, medical expenses, hospital income, and more.

For more information, do contact your MSIG Insurance adviser, or please click here.

*Terms and Conditions Apply.

Did you know? Windscreen damage is often inexpensive to fix and claimable against your comprehensive motor insurance. However, claiming against your motor policy will reset your No Claims Discount (NCD), so it is better to get the Windscreen add-on that is additional coverage for repair or replacement of your windscreen.

Note: From 15 February to 14 August, MSIG will restore your Windscreen add-on sum insured with no additional premium when you choose to repair your windscreen instead of replace*. Choosing to repair saves you time in the workshop and is also environmentally friendly.

For more information, please contact your MSIG Insurance Adviser, or contact us here.

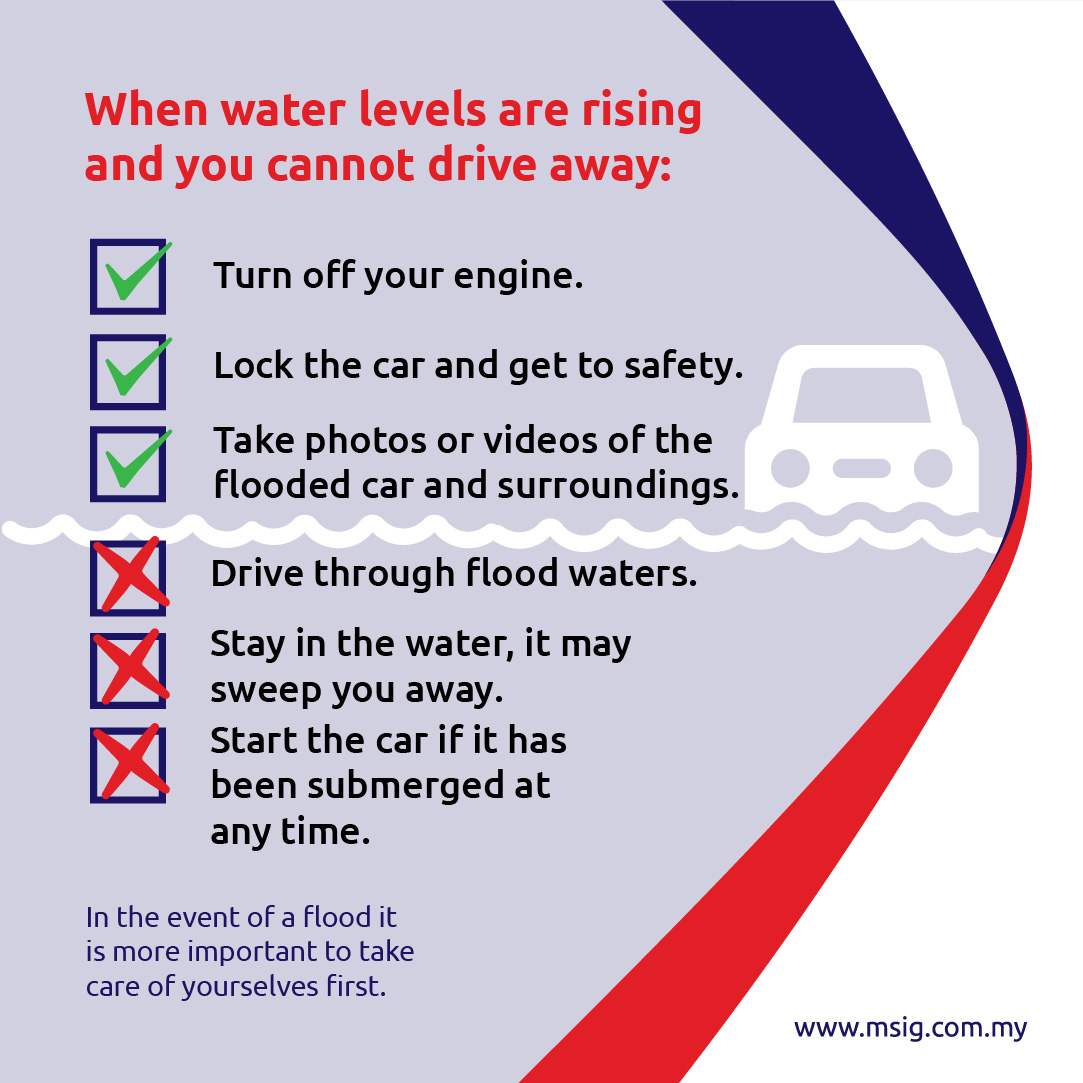

When you’re in your car and the flood water rises, remember these simple actions and make sure you and your passengers are safe.

To find out more about MSIG 24-hr Motor Assistance and the Special Perils add-on, please contact your MSIG Insurance Adviser, or click here to get in contact.

To find out more about Compulsory Excess and other important things to know about making a claim, please contact your MSIG Insurance Adviser, or click here to watch a video about the MSIG Waiver of Compulsory Excess Motor Add-on.

Betterment is an additional charge for cars that are older (normally 5 years and above) to cover the difference of replacing an old part with something brand new. It’s a common practice in the industry when you make a claim.

For more information about Betterment, please contact your MSIG Insurance Adviser.

If you are involved in a vehicle related accident, you should know about Own Damage Knock for Knock or ODKFK – it could make your claims experience much easier and possibly save your NCD as well!

ODKFK allows you to make a claim from your own insurance company instead of the other party’s insurer. This agreement means your claims processing is faster.

For more information about ODKFK, please contact your MSIG Insurance Adviser.

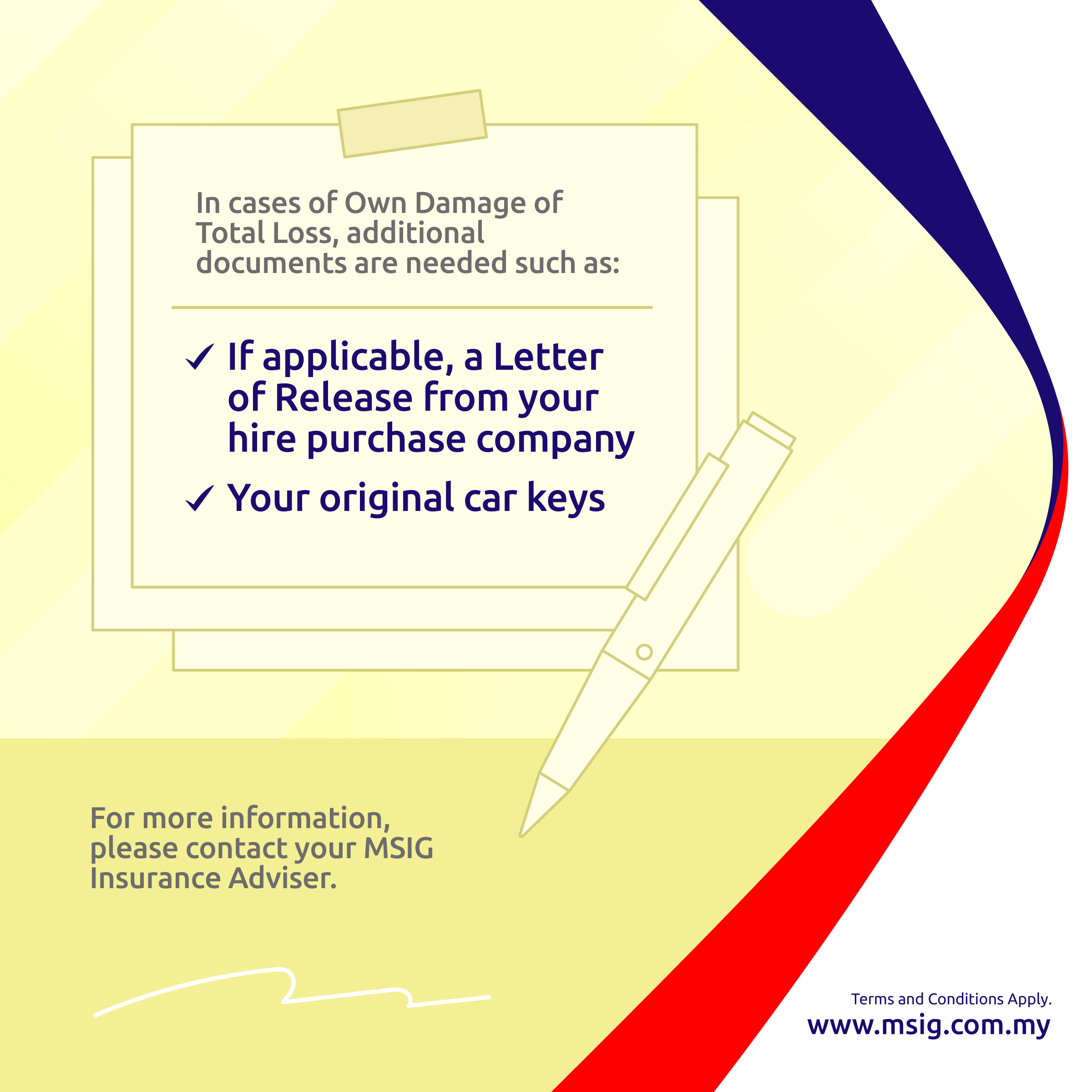

Do you know what to do in the event of an Own Damage Claim? It’s always good to know the basic steps before making a claim.

Please contact your MSIG Insurance Adviser to learn more.

Motor insurance markets were previously regulated with fixed pricing structures called Tariffs. In 2017, the industry began the Phased Liberalisation of Motor Insurance, gradually introducing more competitive pricing and flexibility.

Now, we are transitioning to a more dynamic pricing system based on risk factors such as driver profile, vehicle type, and historical claims data. This approach encourages competition, innovation, and more accurate pricing.

As a consumer purchasing motor insurance, it's important to know the available options. For more information, get in touch with your MSIG Insurance Adviser today!

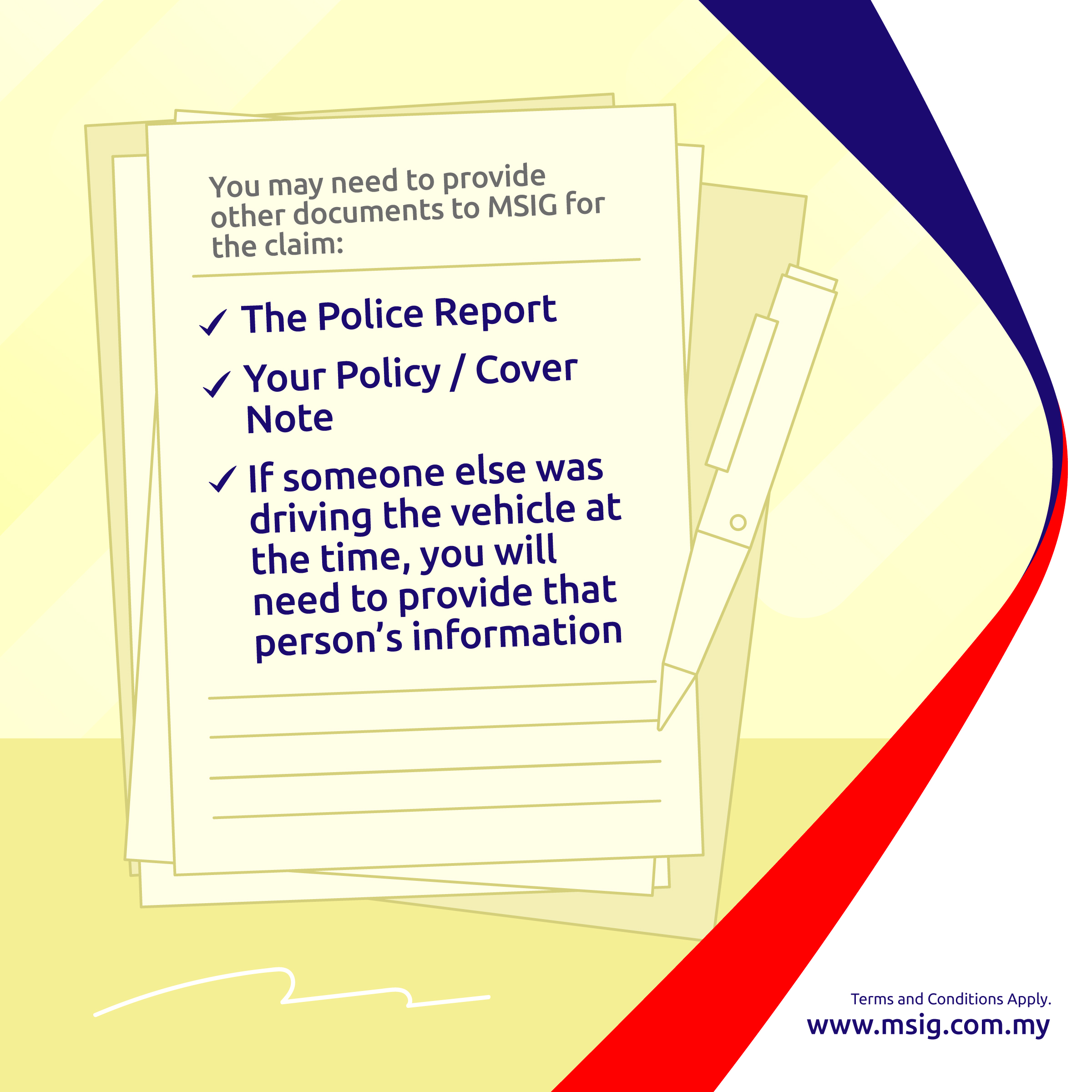

Lodge a police report immediately, get your vehicle towed (if it cannot be driven) to the nearest MSIG approved panel repairer.

Should you decide to make a claim. Notify your MSIG Insurance Adviser as soon as possible! You can find the General Claims Guidelines here.

Do take photos of the accident scene, contact details of those involved, and retrieve any dashcam footage from your vehicle to facilitate and expedite the claim process. Above all, stay calm and composed, MSIG will help you with the rest.

Wonder why choosing an authorised panel workshop is the smart choice? It's not just about reliable repairs, it's about ensuring a smooth process.

MSIG Special Perils Motor Add-on provides insurance coverage against a wide range of hazards including floods, typhoons, and storms. Click here to find out more.

For more information, please contact your MSIG Insurance Adviser.

Do consider getting a Driver’s Personal Accident (DPA) Motor Add-on to protect yourself and your passengers*. In the event that you are injured during the accident, DPA will cover permanent total or partial disablement, medical expenses, hospital income, and more.

For more information, do contact your MSIG Insurance adviser, or please click here.

*Terms and Conditions Apply.

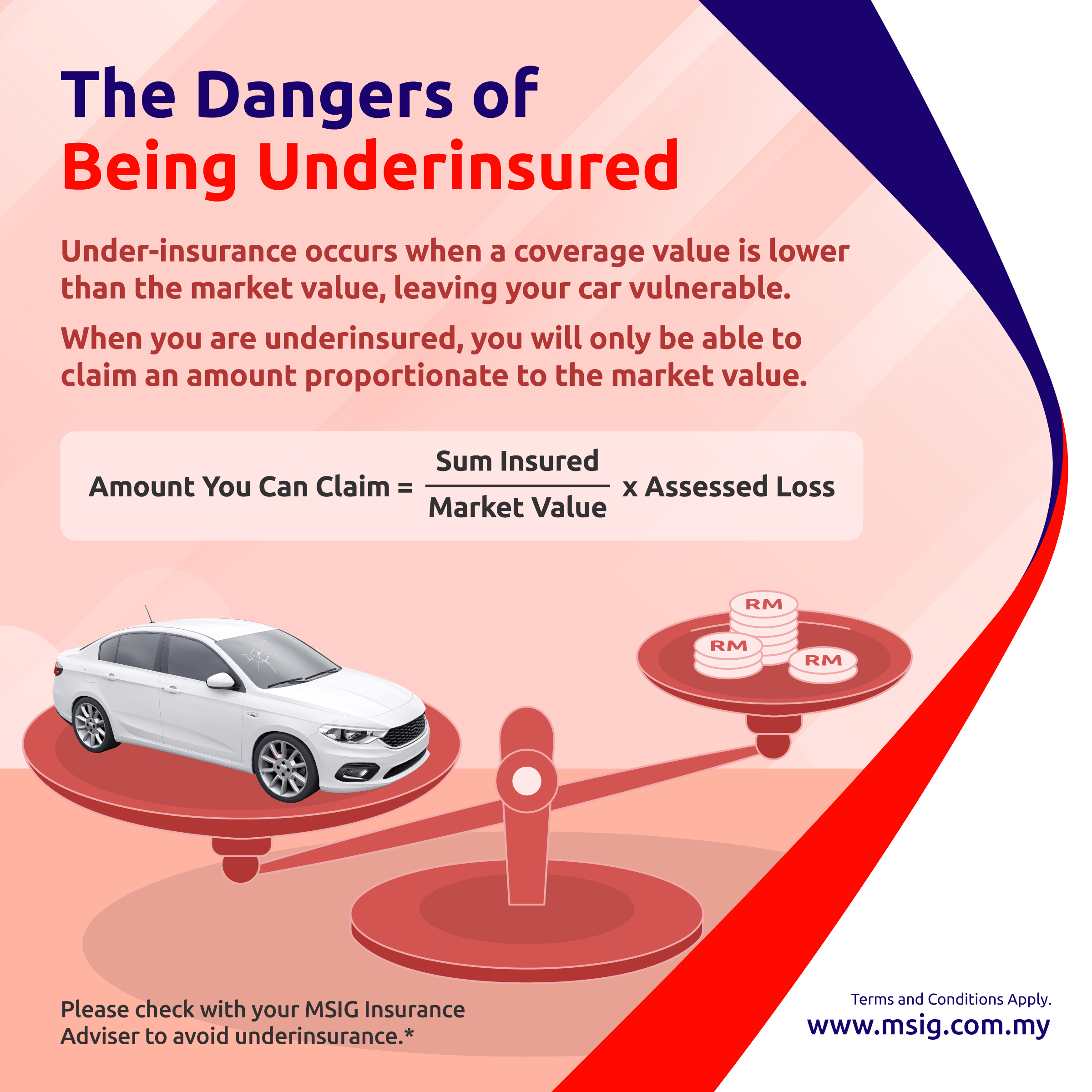

If your vehicle is underinsured, you'll face insufficient compensation from your insurer in the event of accidents, theft, or total loss. This means you may end up covering some repair costs yourself.

Ensure adequate coverage to avoid risks with underinsured vehicles.

For more information please contact your MSIG Insurance Adviser.

The No Claim Discount (NCD) is a familiar term among car owners. It’s a discount provided by insurers when no claims are made during the coverage period. By maintaining a claim-free record, your NCD rate increases, resulting in reduced car insurance premiums.

Maintaining your NCD is a financially wise strategy that rewards safe driving and significant savings on car insurance premiums over time.

To find out more about NCD, kindly contact your MSIG Insurance Adviser.