Personal Insurance

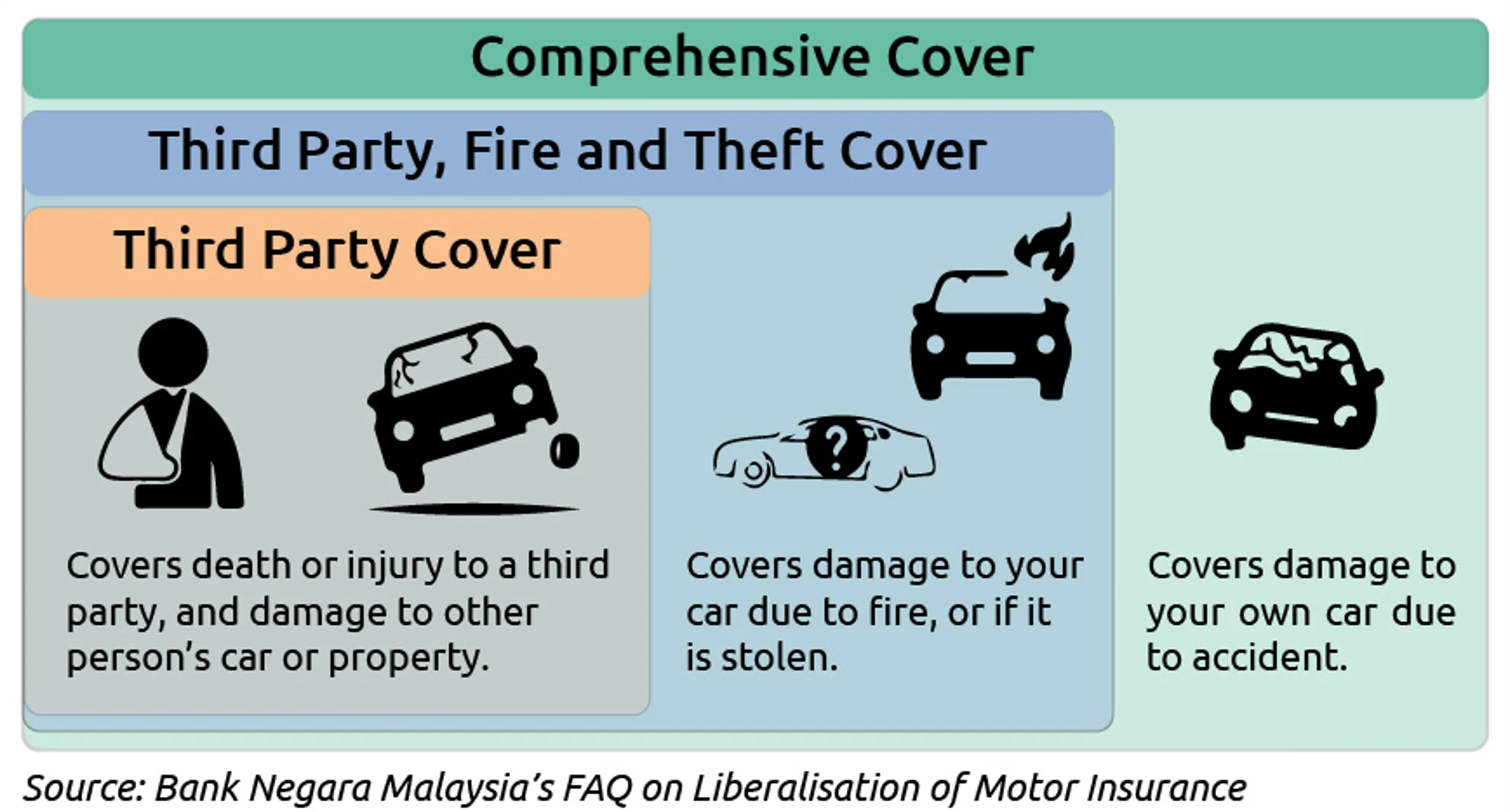

What are the different types of Motor Insurance coverages?

Why is Driver’s Personal Accident Add-on Important?

Why should I get Windscreen Add-on coverage?

What should I do (or not do) if my car is caught in a flood?

What is Compulsory Excess?

Ever Heard of Betterment?

What is ODKFK?

What is Own Damage claim?

Why Motor Insurance Liberalisation is Important?

What should you do in the event of an accident?

Why should I use a panel workshop?

Does the Special Perils add-on only cover flood damage?

Why is Driver's Personal Accident (DPA) coverage important?

What are the risks of being underinsured?

What is No Claim Discount (NCD)?